Milele Junior: Britam offers Rotarians Child-Only Cover

By Britam General Insurance

The structure of families is rapidly evolving, and so are their healthcare needs. In Kenya, like in many parts of the world, traditional family units are no longer the only norm.

Single-parent households, blended families, and guardians who are not biological parents are increasingly common. These modern family dynamics necessitate flexible and inclusive health insurance solutions.

Traditionally, children in Kenya have accessed health insurance through family packages purchased by their parents or guardians.

However, this leaves many children without adequate coverage, particularly in non-traditional family setups. Data from the Kenya Demographic Health Survey (KDHS) 2022 shows that only 20.9 percent of children below 15 years have health insurance, showing the disparity that Britam aims to solve.

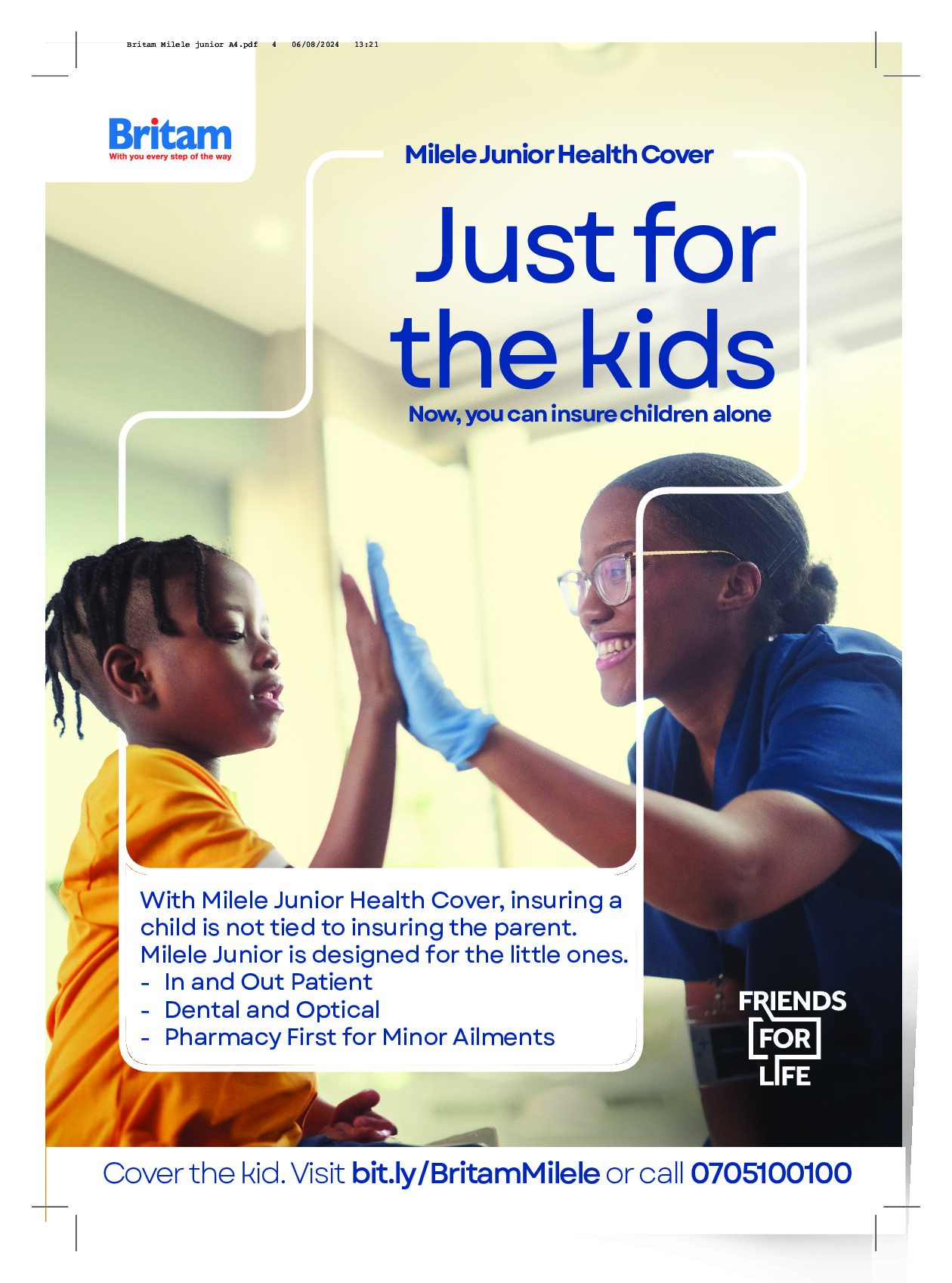

Milele Junior, a child-only health plan by Britam General Insurance, ensures that no child is left uninsured, regardless of their household’s access to family health packages. The health insurance package is designed exclusively for children aged between 37 weeks and 18 years.

With health insurance uptake among the economically active population in Kenya still relatively low — only 28.7 percent of those between 15 and 49 years are covered.

Milele Junior seeks to improve these statistics by providing affordable, tailored insurance options for children.

The comprehensive medical cover includes inpatient, outpatient, dental, and optical benefits. It allows parents and guardians to secure standalone health cover for their children, addressing diverse health needs.

The cover provides for bed and lodging charges, vaccines, pre-existing, chronic, and congenital conditions, doctors’ fees, diagnostics, COVID-19 coverage, and prescribed drugs.

This ensures that every child’s health needs are taken care of until they reach the age of 18, at which point they can seamlessly transition to Britam’s main Milele health cover with minimal requirements.

Milele Junior is available in four variants, each crafted to cater to different levels of healthcare requirements for children:

- Milele Junior Advantage: Offers full inpatient coverage for pre-existing illnesses, and chronic, and congenital conditions. It provides access to all hospitals, physicians, and healthcare providers on the Britam panel.

- Milele Junior Premier: Similar to Milele Junior Advantage but includes a sub-limit structure for pre-existing illnesses, chronic, and congenital conditions. It also provides access to all hospitals, physicians, and healthcare providers on the Britam panel.

- Milele Junior Essential 1: A cost-conscious option offering medical insurance and last-expense cover. It provides access to a wide range of medium and low-cost hospitals within the Britam panel.

- Milele Junior Essential 2: Another cost-effective option targeting clients seeking medical insurance and last-expense cover, offering access to a wide range of mission and referral hospitals on the Britam panel.

This article is brought to you by our valued sponsor, Britam Genral Insurance. While Rotary District 9212 proudly shares this information, we encourage readers to conduct their own research and make informed decisions when making a purchase.